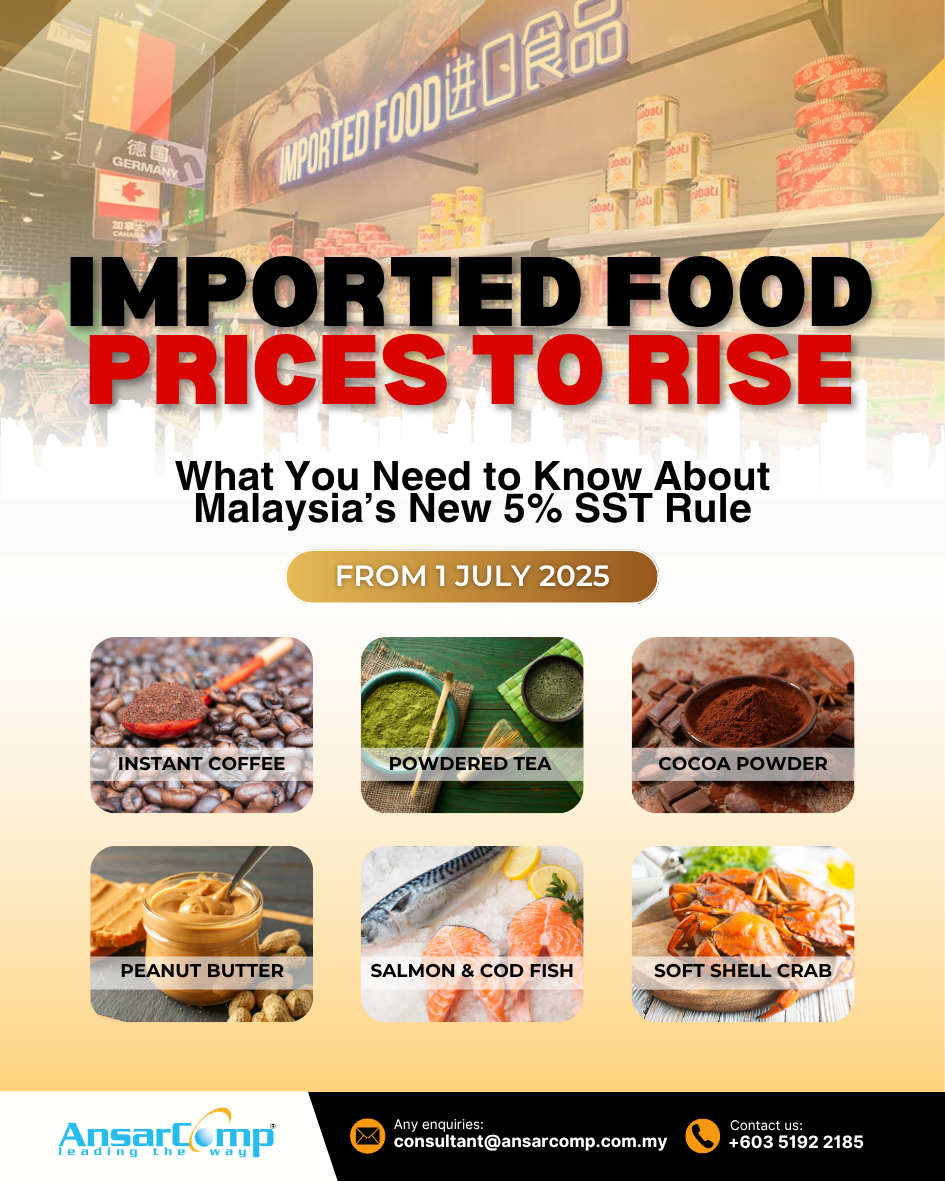

Effective 1st July 2025, Malaysia will implement a 5% Sales and Services Tax (SST) on a range of imported food items, following an announcement by the Ministry of Finance.

This tax adjustment aims to expand the nation’s revenue base, but it will also bring significant implications for businesses involved in importing, distributing, and selling these products.

🛒 What Items Will Be Affected?

The list of affected goods includes:

* ☕ Instant coffee

* 🍵 Powdered tea

* 🍫 Cocoa powder

* 🥜 Peanut butter

* 🐟 Salmon

* 🐠 Cod fish

* 🦀 Soft shell crab and king crab

* …and various other imported packaged food products

You can view the full list of HS Codes and tax updates on the official Malaysian Customs portal: www.customs.gov.my

📊 Why Does This Matter to Your Business?

This 5% SST may seem minimal at first glance, but it could:

* Increase operating costs for food importers, retailers, and restaurant chains

* Trigger price adjustments across the F&B supply chain

* Create compliance risks if importers are unaware of their updated obligations

* Lead to delays at customs checkpoints if documentation is incomplete or unclear

Whether you’re importing under your own license or using an appointed Importer of Record (IOR), understanding how this tax applies to your product portfolio is critical to avoid penalties and disruptions.

💼 How AnsarComp Supports Businesses During Regulatory Shifts

At AnsarComp, we understand the complexity of international trade and regulatory compliance in Malaysia. With over 20 years of experience, we help importers, exporters, and brand owners to adapt quickly and confidently.

Here’s how we can support you ahead of the July 1st deadline:

✅ Product Classification & SST Impact Analysis We’ll help determine whether your products fall under the new taxable categories and how they’re classified under Malaysia’s HS code system.

✅ Regulatory & Tax Advisory Services We advise on SST applicability, customs clearance documentation, and strategic steps to reduce compliance risks.

✅ Agency Coordination We liaise with Customs, MAQIS, MOH (KKM), and other regulatory bodies on your behalf to ensure fast and accurate approvals.

✅ End-to-End IOR/EOR Services From documentation to delivery, AnsarComp simplifies the regulatory landscape so you can focus on your business.

🧭 Don’t Let 5% SST Catch You Off Guard

This SST implementation is not just a government formality—it could impact your costs, pricing strategy, and profit margins. Getting professional help is not only a good idea; it’s essential.

📩 Reach out to AnsarComp today to schedule a custom SST Impact Assessment tailored to your products and trade routes.

🔗 [Contact Us Now +6011 3120 2252] | Visit: www.ansarcomp.com.my 🔗 Check SST Details at Malaysia Customs Website