Did you know that recent changes to Malaysia’s Sales and Service Tax (SST) rules are affecting how businesses import, deliver, and store goods?

Unfortunately, many companies are unaware that they’re already breaking these new regulations — and the consequences can be costly.

Let’s break it down simply 👇

What’s Changed?

The new SST expansion means more services and goods now fall under the tax umbrella. This includes:

* Logistics and freight forwarding

* Warehousing and storage

* Local delivery services

It’s no longer just about what you sell — it’s about how your goods move.

The Risk of Not Knowing

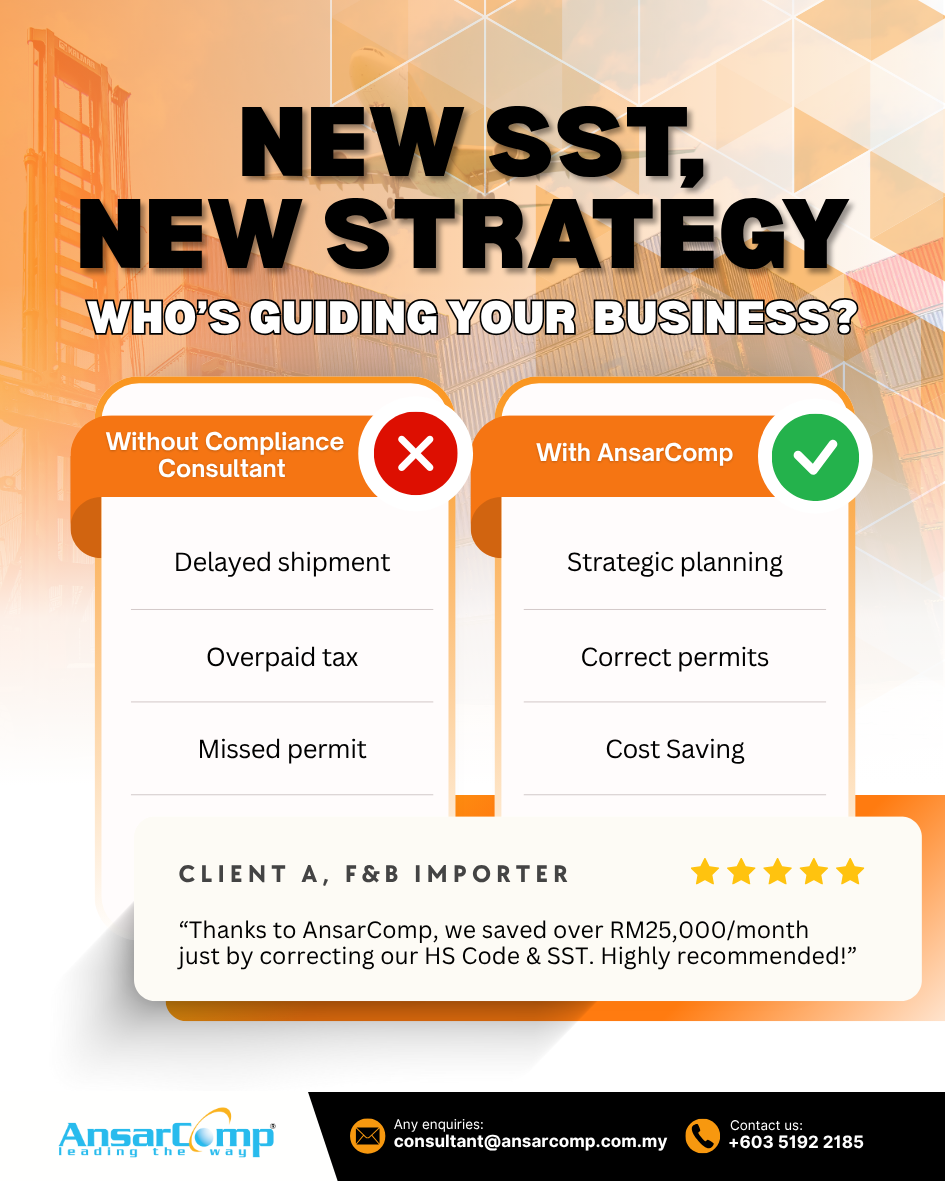

Without proper guidance, many businesses end up:

❌ Calculating the wrong SST amount

❌ Not realizing their goods need special permits

❌ Getting stuck at customs, causing delays and losses

How AnsarComp Helps

At AnsarComp, we’re more than just a consulting firm. We’re your partner in navigating Malaysia’s complex regulatory system.

👩💼 What we do:

✅ We understand how government systems and agencies work ✅ We know the correct documents and permits for your product ✅ We make sure your goods clear customs — quickly and legally

Don’t Wait Until Your Shipment Is Stuck

The worst time to find out about SST rules is after your goods are held at the port.

Whether you’re importing electronics, food, cosmetics, or raw materials — let us help you plan the right way.

📲 Talk to us before you ship. Save time, avoid penalties, and stay compliant.